New Paragraph

SONAS WEALTH

Pronounced sō-,nas Origin & Meaning: (noun) Irish Gaelic for

Happiness, Prosperity, Good Fortune

CREATE - ENJOY - TRANSFER

We're proud to provide our world-class financial solutions in the suburbs. Let us help you create, enjoy and in the future, transfer your wealth.

Alata

Alice

Open Sans

Noto Sans

Bebas Neue

Great Vibes

Rock Salt

Exo

Belgrano

Overlock

Cinzel

Indie Flower

Staatliches

Roboto Slab

Lato

Noto Serif

Open Sans

Montserrat

Ubuntu

Rubik

Delius

Amiri

Montserrat

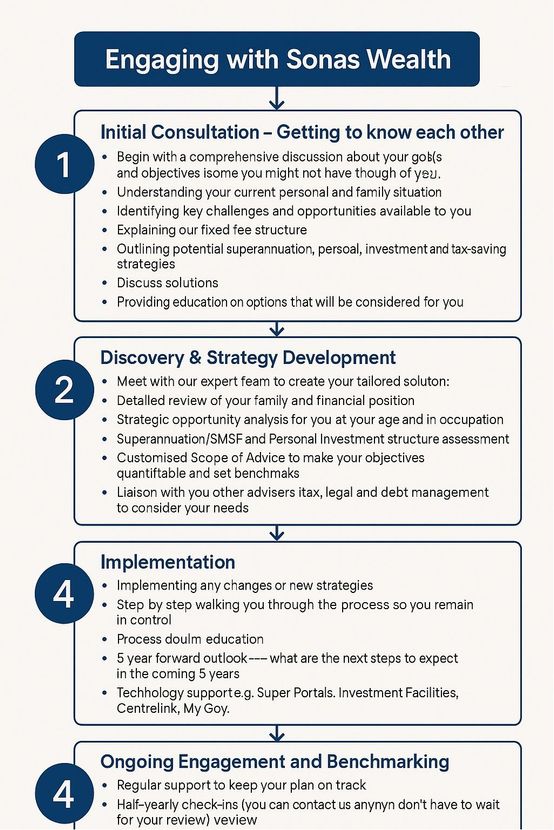

Learn about our financial services

Wealth management

Get investment advice that helps you manage your wealth for today and tomorrow from our dedicated team of financial specialists.

Retirement planning

It’s never too soon or too late to adopt strategies to support your retirement goals. Our financial professionals will help you develop a workable plan.

Estate planning

Get the trusted advice you need to manage your estate and assets. Bring your questions to us and we'll provide you with everything you need to make informed decisions.

Create Wealth.

Enjoy That Wealth.

Transfer that Wealth on Your Terms.

Liam is extremely approachable, knowledgeable and provides information in a clear, concise and easy to understand manner. Liam takes the stress out of what can be very complex matters and we feel extremely comfortable under his guidance.".

Alison, Cherrybrook

Liam helped us to clarify financial goals and explore future planning. His compassionate approach made us feel confident in our understanding of financial matters and decisions. His knowledge and experience gave us a sense that we could trust him to assist us with our future needs."

Candice, Kellyville

"Liam is one of those rare financial advisors who looks at your finances holistically. He applies common sense and good sound advice, is down to earth and totally relatable. He knows super laws and changes inside out and is up to date with any new or possible future legislation change proposals. He will also answer general financial questions and is just a great guy."

Anne-Louise,

Lane Cove